I’m going back, way back to 2005. I was a runt of a kid trying to understand this novel invention known as the FAFSA, or the Free Application for Federal Student Aid. Little did I know that years later, my decision to accept federal loans would directly affect my life today.

In a way, I’m glad that loans were available for me to attend college. I wouldn’t have been in the job position I was today if I hadn’t chosen the path I did. At the same token, I’m holding student debt over $35,000, and even with consolidation, about 20 percent of my salary goes towards paying off student debt.

And I’m not alone in this situation.

Student loan debt has surpassed credit card debt in the U.S. Frankly, this is really sad, especially if you also have credit card debt.

For many of us post-grad millennials, we can just accept our college receipt and continue to pay on. For others, student debt has forced them to take another route.

Martin Fuentes, a 2009 graduate from UC Riverside says, “It's been a struggle, considering how much I owe back. I've enrolled back in school just so I can defer my loans.” In fact, coupled with a recession and steady unemployment, going back to school to defer your student loans doesn’t seem like a bad idea.

But what if you had to take out additional loans to go back to school? Here’s what you will be facing in 2012.

According to The Bottom Line, UC Santa Barbara’s student newspaper, “Interest rates on subsidized Stafford Loans, estimated to account for almost half of all federal student loans, are scheduled to double on July 1 unless Congress intervenes. The interest rates will rise from 3.4 percent to 6.8 percent and will cause an estimated $5,000 increase in loan payments for students.”

What does President Obama have to say about the potential for interest rates to double? In his January State of the Union address, the President said that he wants to extend the lower interest rate on federal loans and permanently extend the American Opportunity Tax Credit. He even placed colleges in-check! He called them out saying:

“Let me put colleges and universities on notice: If you can’t stop tuition from going up, the funding you get from taxpayers will go down. Higher education can’t be a luxury -– it is an economic imperative that every family in America should be able to afford.”

(Oh dang!)

Unfortunately, it should be stressed that he said “should be able to afford.”

As for the Republicans, they provide solutions for general education from K-12, but not much is stated concretely on their official websites of their positions on student loans.

Is anyone going to fix the current financial plague accosting higher education? The worst part is that to stay competitive in this economy, a college degree is almost a requirement for many entry-level positions.

Rhommel Canare graduated from UCLA in 2008, and went on for a Master’s degree at San Francisco State University. When I asked whether it was a good idea to take out loans he said, “Well, with how college fees are today, I think we have no choice. Especially since college degrees hold capital in society, you need degrees and credentials to survive. In the long run, it’s a good investment, but fees are increasing and financial aid is decreasing.”

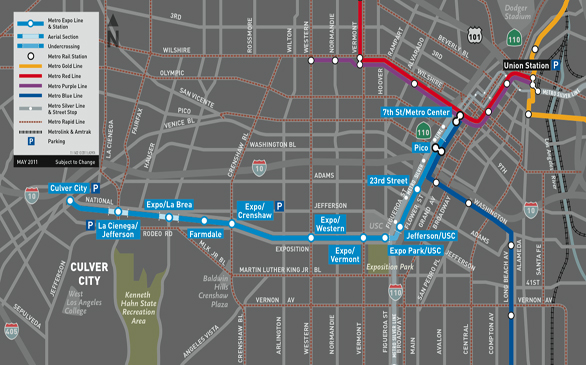

If there is any sliver of good news for us, we can rest assured that our current governor is pursuing a plan for UCs, Cal States and Community Colleges.

You can view them here, and see for yourself whether the plan is feasible.

Also in effect for 2012 is Obama’s plan to reduce the maximum required payment on student loans, from 15 percent of discretionary income annually to 10 percent. Additionally, the White House says the remaining debt would be forgiven after 20 years, instead of 25.

Such measures offer a little consolation while I eat my Ramen noodles.